arizona vs nevada retirement taxes

However there are a few places that are more expensive like Kingsbury and Gardnerville. Nevada is also devoid of.

Arizona Vs Nevada Which State Is More Retirement Friendly

You might be able to glean from the following information whether or not Nevada is the place for you to spend your retirement.

. The median income is almost the same around 52000 with Nevada in a slight advantage. Such as 401 ks and IRAs hence the moderate tax-friendly label. What is taxed is the retirement incomes from.

Nevada No income tax low cost of living and warm weather. Nevada might be the better choice in this instance. Alaska Florida Illinois Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas.

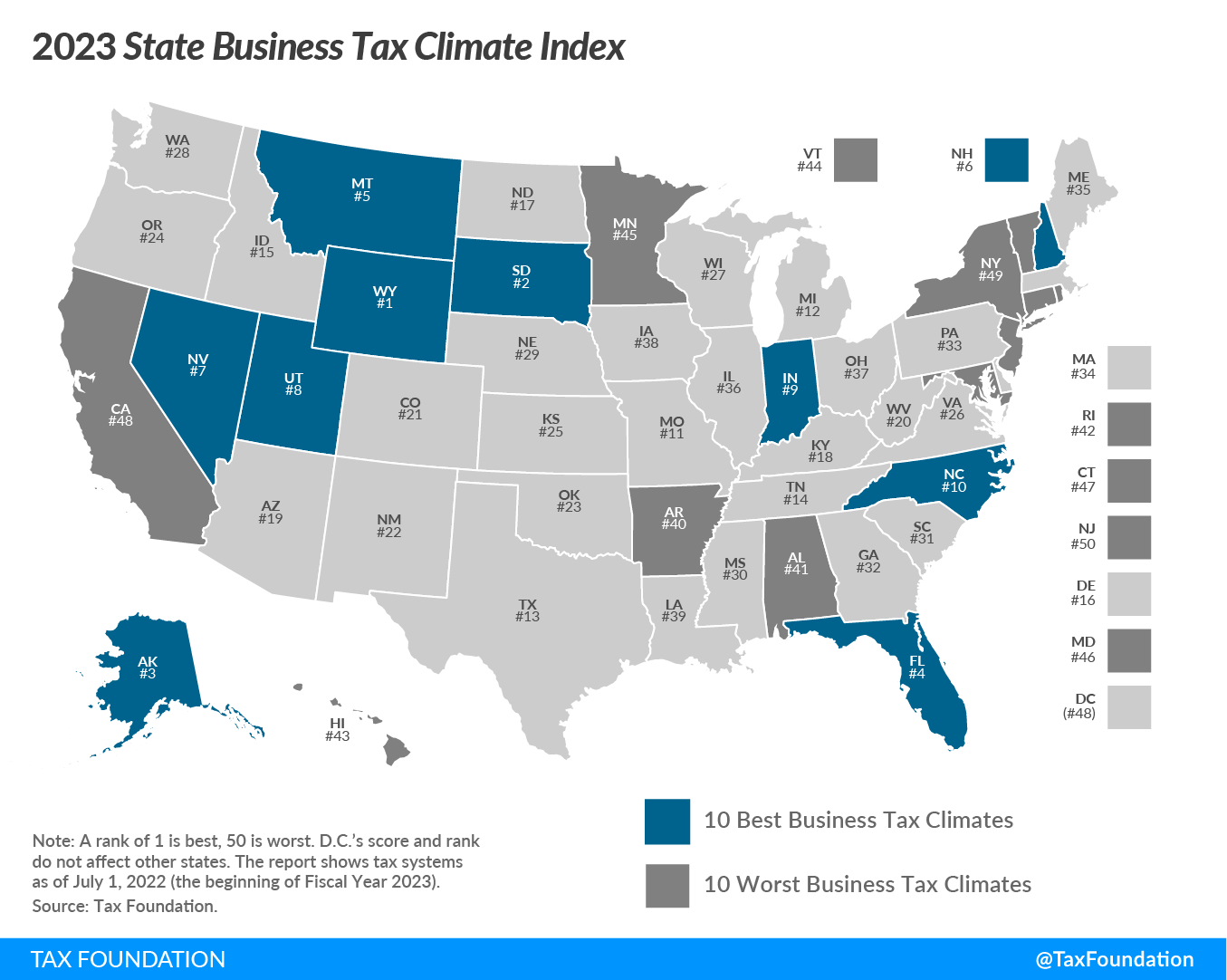

Nevada might be the better choice in this instance considering it doesnt have a state income tax compared to Arizonas reasonably low state income tax of 2598. This tool compares the tax brackets for single individuals in each state. As of 2022 eleven states have no tax on regular or retirement income.

There are a few things that make. Local sales taxes increase this total with the largest total rates hitting 105. Consumers in California are hit with a sales tax of 725.

Texas No income tax super low cost of. Pros of Retiring in Nevada. Retiring in Nevada comes with pros and cons.

Discover whats next Call Us. The median income is almost the same around 52000 with Nevada in a slight advantage. Our blog has the latest news trends and insights about over 2000 active adult retirement communities in the US.

Arizona does not tax Social Security retirement benefits. Arizonas income tax rate runs between 259 and 450 and this unfortunately includes retirement income. 29 on income over 440600 for single filers and married filers of joint returns 4 5.

Arizonas property taxes are relatively low but sales taxes are fairly high. However Arizona does charge state income tax as well as taxes on most retirement sources. This adds a significant toll to purchases.

Arizona Low state income tax low cost of living and warm weather. Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. Distributions from retirement savings accounts like a 401k or.

Retirement income tax breaks start at age 55 and increase at age 65.

9 Things You Must Know About Retiring To Arizona Kiplinger

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

Best Worst States To Retire In 2022 Guide

37 States That Don T Tax Social Security Benefits The Motley Fool

Arizona Vs Nevada Where S Better To Retire

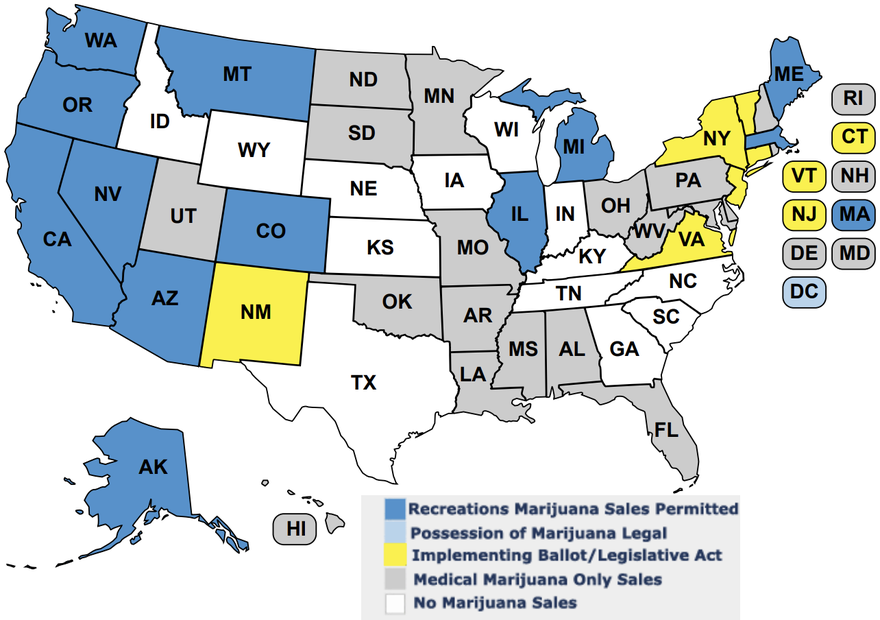

Marijuana Tax Revenue A State By State Breakdown The Motley Fool

Which States Are Best For Retirement Financial Samurai

The True Cost Of Living In Arizona

Study How Tax Friendly Is Utah Compared To Every State Abc4 Utah

10 Most Tax Friendly States For Retirees Kiplinger

Arizona Vs Nevada For Retirement 2021 Aging Greatly

9 Things You Must Know About Retiring To Arizona Kiplinger

Arizona Vs Nevada Which State Is More Retirement Friendly

10 Best Places To Retire In Nevada Smartasset